In today’s economy, it seems the average time spent working for a company is five to seven years before moving onto another company. Although it may surprise you, there are still many people who have worked at the same company for several decades.

Many of the clients we serve have been working at the same company for over 30 years. The biggest benefit at work for most Americans is a 401(k) retirement plan. If you work for publicly traded company, and have been investing in your employer’s stock, these shares may provide a huge advantage in retirement years down the road. At Apriem, we serve many clients who are investing in their employer’s stock through their 401(k). In fact, according to research at the University of Chicago, over 11 million Americans take a concentrated stock position in their retirement accounts. This means that 20% or more of their retirement account is invested in their employer’s stock. The combination of investing in company stock within the 401(k) plan can become a winning combination with Net Unrealized Appreciation (also known as NUA).

What is the NUA Rule?

Currently, federal tax laws contain a little-known rule that apply to certain transfers of company stock from an employee’s 401(k). Only the cost basis of the stock (what was originally paid for the stock) is taxable upon distribution/transfer. The difference in the market value of these shares, minus the cost basis, is the Net Unrealized Appreciation. The NUA is not taxable until the shares are sold and are not subject to early-withdrawal penalties. This is particularly beneficial to early retirees, who need to access retirement income before age 59 ½, to avoid early withdrawal penalties (10% plus ordinary income taxes).

Currently, workers who leave their company or retire select from the following options for their retirement savings:

- Continue to hold shares of stock in their employer’s plan

- Transfer the stock to an IRA, using a tax-free rollover

- Take the entire amount as a withdrawal

- Transfer a portion to their IRA and take the remainder as a lump-sum distribution

The most common choice by individuals is to rollover the entire balance of the 401(k) to an IRA, tax-free. This seems like the most sensible decision, since the entire balance will not (immediately) be subject to taxation. However, if your 401(k) includes company stock, a rollover of the entire amount may not be the most favorable outcome.

What are some key NUA tips?

- The opportunity or “triggering event” to use the NUA strategy occurs when leaving your employer, retiring, turning 59 ½, having a disability, or death.

- You are only given one chance to use the strategy.

- If you rollover without NUA, you lose the capability to use NUA in the future.

Is NUA the right tax strategy for me?

The first step to take is to determine the cost basis. Your human resources department can help with this, or the investment firm that manages the retirement savings plan can assist as well. The cost basis of company stock is the price paid over a period of time to acquire the shares of stock. This is important because it will determine how much ordinary income tax the participant would be responsible for, if choosing NUA. Knowing the cost basis will also help determine what the capital gains tax would be once the company stock is sold.

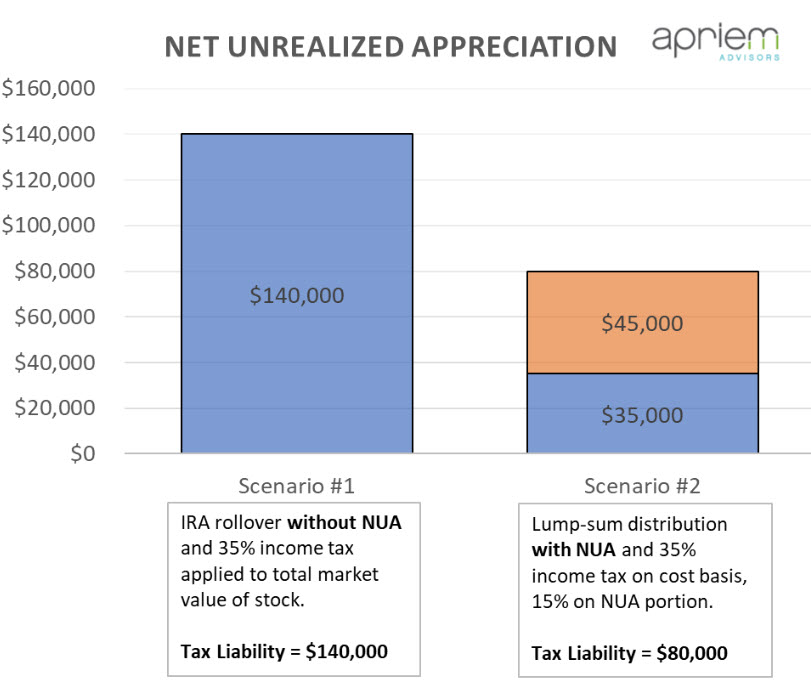

To make things clear, we will illustrate two scenarios. One will cover the traditional rollover option and the second will speak to the NUA option. Suppose the employee in question has worked for a company 30+ years and is close to retirement. Assume they have accumulated 5,000 shares of stock in a 401(k) plan and the stock is trading at $80 per share. As a result, the total market value of the stock is $400,000. If the cost basis in purchasing these 5,000 shares is $20 per share, your total NUA would be $60 per share, or $300,000.

Scenario One:

If you were to liquidate the shares of stock and withdraw the amount in cash or rollover the entire balance of the 401(k) and take distributions from an IRA, taxes would be based on the ordinary income tax rate. Assuming this is 35%, the total tax would be $140,000.

Scenario Two:

If you were to transfer the entire amount of shares in-kind, the NUA rule would apply and the total tax would be calculated as follows. The cost basis would be taxed as ordinary income 35% on the $100,000 paid to acquire the stock. ($20 per share, times 5,000 shares). The tax would be $35,000. The remainder ($60 per share) would be taxed at 15%, equal to $45,000. Total tax paid in this scenario, $80,000.

Asset Allocation vs. Asset Location:

You may have heard our Senior Financial Planner, Chris Whitaker, CFP®, AIF®, talk about the concept of Asset Location. The concept refers to where your investment is held, and what its role is within your portfolio or financial plan. By enacting the NUA rule and moving some of the highly appreciated stock to a non-IRA account (such as a family trust or brokerage account), the concept of asset location comes alive.

In retirement years, you may want to make a large purchase. Perhaps a purchase of family real estate, new car, or once in a lifetime travel. If funds are available outside of an IRA account, and subject to capital gains rates instead of ordinary income tax rates, your accountant will be pleased.

This can be an overwhelming and complicated topic. At Apriem, our team is here to educate and to simplify your financial life. Please talk to your advisor to see how NUA can help you.

Disclosures:

References: University of Chicago

Advisory services offered by Apriem Advisors (“Apriem”), a registered investment adviser with the United States Securities and Exchange Commission in accordance with the Investment Advisers Act of 1940. Any reference to or use of the terms “registered investment adviser” or “registered,” does not imply that Apriem Advisors or any person associated with Apriem Advisors has achieved a certain level of skill or training. Apriem Advisors may only transact business or render personalized investment advice in those states and international jurisdictions where we are registered, notice filed, or where we qualify for an exemption or exclusion from registration requirements. For complete information about our firm, please refer to our Form ADV Part 2A, 2B and CRS at any time.

The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. Past performance is no guarantee of future results. The reader should not assume that investments in the securities identified were or will be profitable.