| Do you remember television informercials? These programs were more than commercials. They pushed the boundaries of television while revolutionizing product advertisement. Nearly thirty minutes in length (unheard of today), these informercials captivated audiences who then turned and purchased the effectively marketed product. One of the most successful informercials promoted the Showtime Rotisserie Oven. Starring Ron Popeil, the “father of the infomercial”, Ronco product sales totaled more than $1 billion USD over the past fifty years.1 Popeil was gifted at making products memorable and was known to use fun phrases during his pitches. Among the many, “Set it and forget it!” was my favorite. While good for Ron Popeil’s salesmanship, “Set it and forget it!” takes on a whole new meaning in the investment world. |

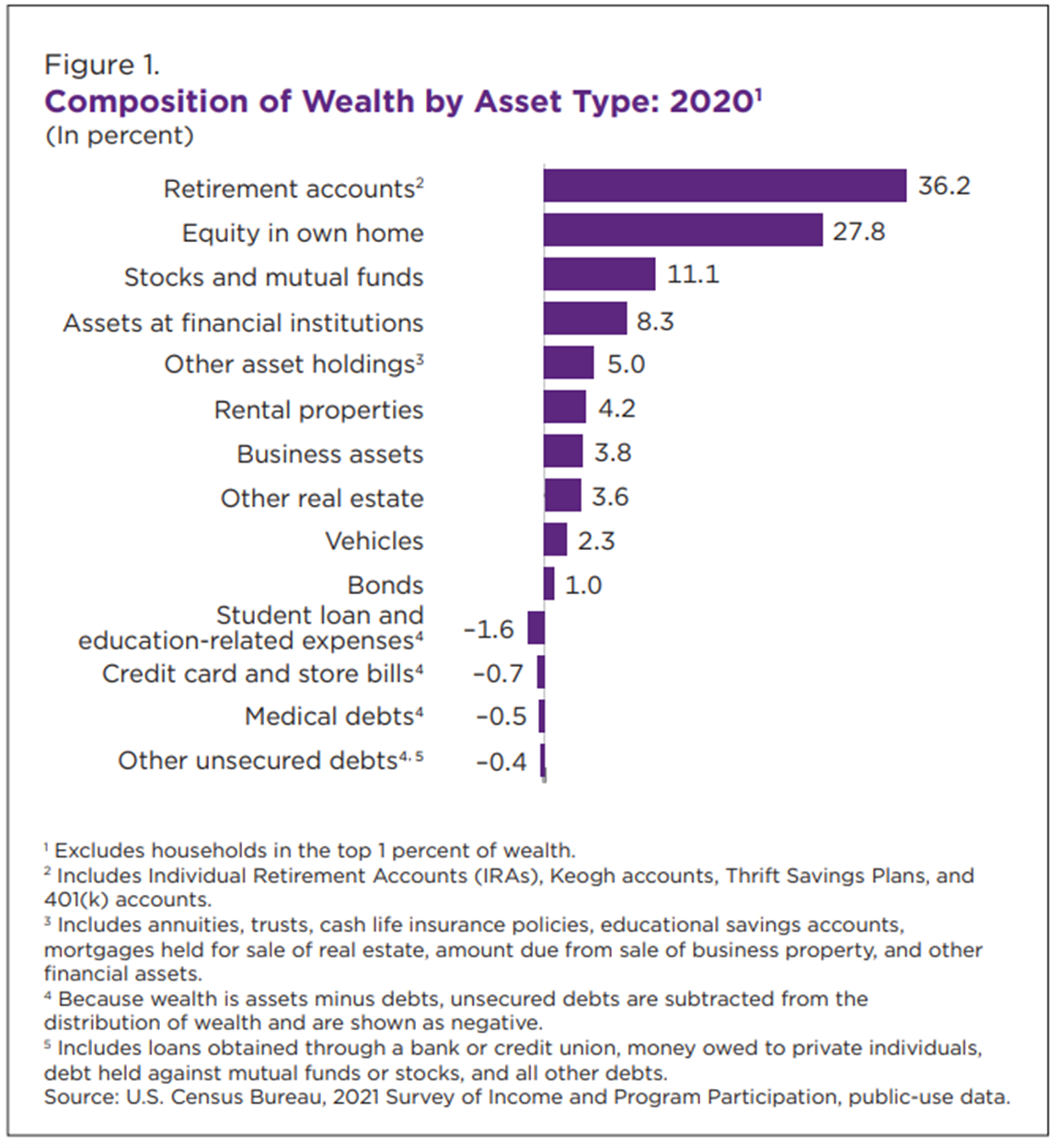

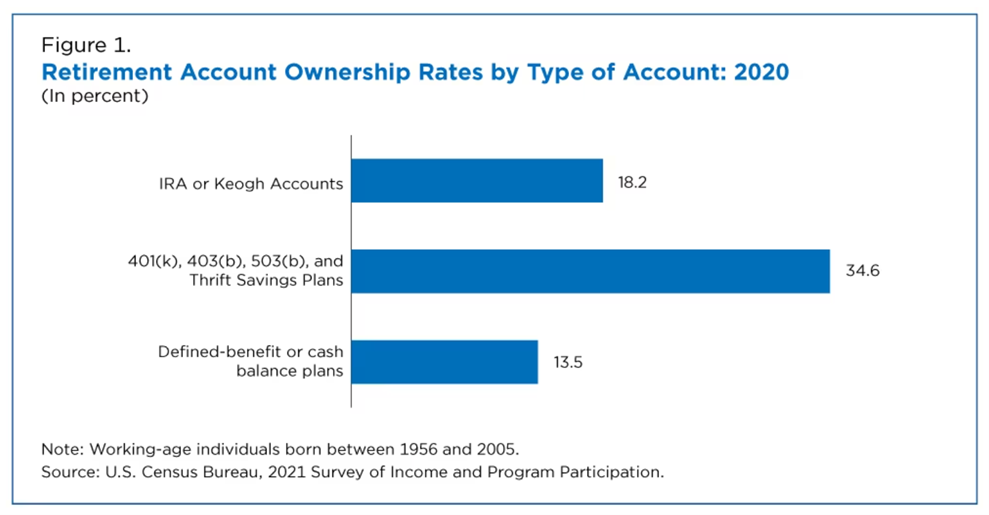

| Company-sponsored retirement accounts have become one of the most common ways Americans save for retirement. According to Vanguard’s preview of “How America Saves 2023”, the average participant account balance was $112,572 as of year-end 2022.2 According to the most recent census The Wealth of Households 2020, excluding households in the top 1% of wealth, retirement accounts are the largest personal asset (36.2%) with home equity only on second place (27.8%).3 |

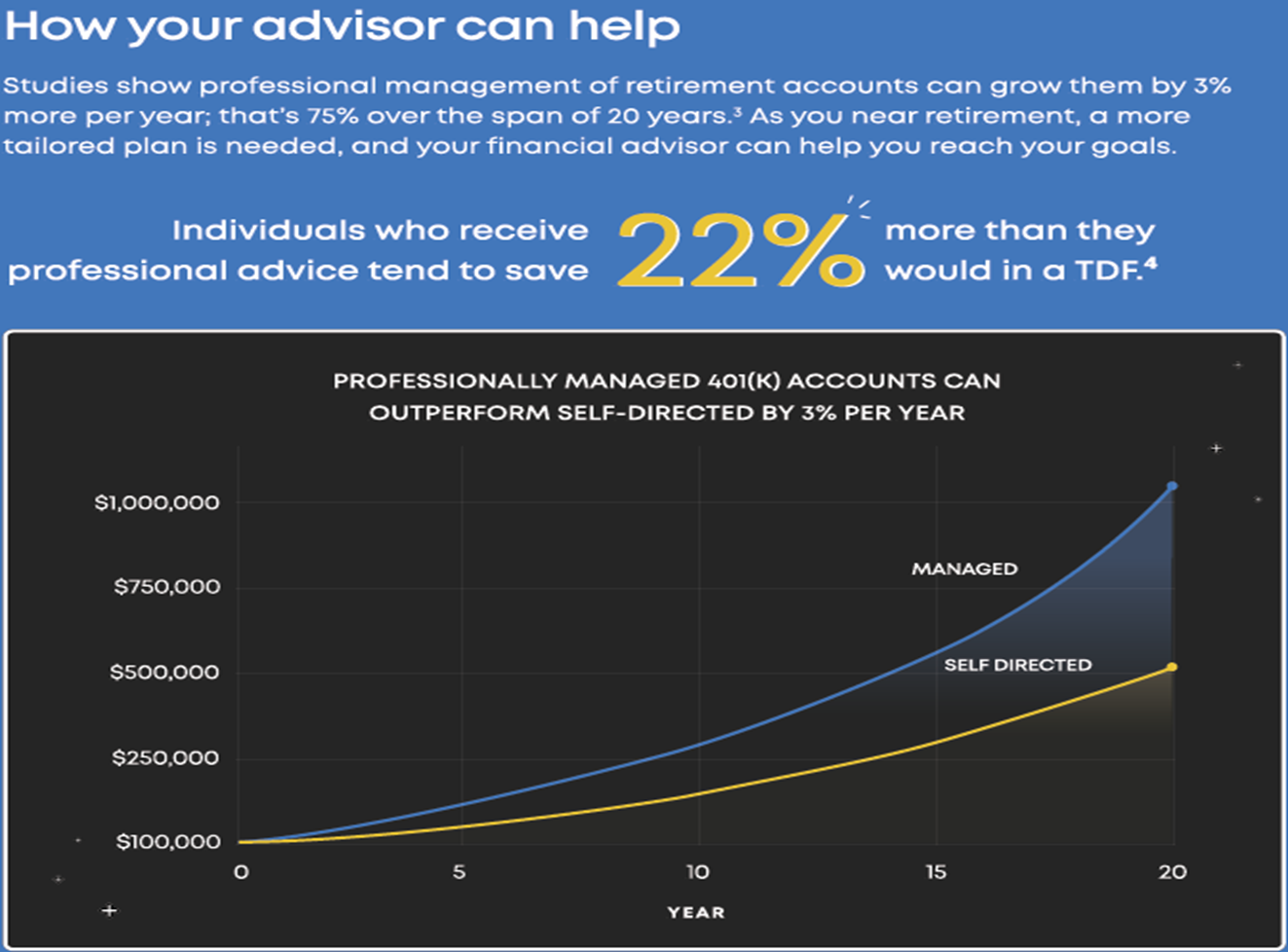

If retirement accounts are what makes up most of household wealth, it would stand to reason that individuals would invest time and energy into their 401(k) choices. Furthermore, routinely assessing their 401(k) account and understanding the selections made in that 401(k) would likely result in optimal value for that retirement account. However, this is not the case. Many “set” their 401(k) choices and “forget it.” They don’t revisit their account with any regularity, and many lack understanding of what they chose for their investments. What might happen to that 401(k) account if the individual revisited the account at a six-month interval, or even on an annual basis? It is very likely that these behaviors could generate a higher return than a target date fund.

Source: Pontera

With such a large percentage of net worth in one account, there are some questions that arise. How do most manage and maintain these significant savings? Do employers help their employees with investment education? Over the course of one year, how is success measured? Do retirement plan participants even know what they own?

In most companies and organizations, retirement plans are set up shortly after an employee is hired. Once enrolled in these plans, the employee selects their amount to defer from each paycheck and with this amount deferred, investment choices are made. A JP Morgan Chase Plan Participant study found that 51% of respondents need direction and are willing to spend time with a financial planner; this increases to 65% in younger respondents under the age of 30. Furthermore, 62% of respondents wish they could completely hand over retirement planning to a trusted advisor. From these data points, it makes sense that though many choose to “set it and forget it,” a significant number are open to partnering with an advisor for their 401(k)investment choices.4

At Apriem, we continually seek cutting edge solutions to grow your personal savings. We want you to be more effective in choosing your retirement savings investments. Our goal is to bring scalable and affordable financial advice beyond retirement rollovers and brokerage accounts. Starting today, Apriem Advisors can proactively manage and rebalance your company retirement account to keep your retirement savings on track prior to your retirement date.

Apriem’s new service offering External Account Management provides an additional service of discretionary management to implement asset allocation and rebalancing strategies for “held-away” accounts such as 401(k), 403(b), & 457(b). We will research the available investment options in these accounts, monitor them, and rebalance and implement our strategies in order to help you achieve your overall financial objective. Don’t just “set and forget” what could be your largest asset, take charge. Contact your wealth manager to see how we can help.

Landon Yoshida, CRPC®, AIF®

VP-Wealth Management & Principal