Market UpdateMarket Update

Lessons From 2025: Discipline Over Drama

I always enjoy writing these year-end recaps. It’s a great way for me to reflect on the past year—on calls investors got right and wrong, things that went according to plan, and where things just went off track. 2025 wasn’t any different. As we close the books on the year, I’m struck by how much of this year was driven by emotion rather than outcomes. Headlines were loud, opinions were strong, and market narratives shifted almost weekly. Yet beneath the noise, markets behaved far more rationally than many expected. Large American stocks logged another double-digit year; international equities did even better; and bonds posted some of the best returns in the past few years.

It reminded me of watching my daughter play soccer or football—every game feels dramatic in the moment, but by season’s end, it’s consistency and fundamentals that determine results. Markets were no different this year.

Tariffs, Politics, and Investor Behavior

Early in 2025, renewed tariff threats dominated headlines. At one point, many economists were predicting a 50% probability of recession. Well, that never happened. Over time, markets gradually became less reactive to tariff rhetoric, and many of the most aggressive proposals were ultimately pulled back. The more important lesson wasn’t about trade policy—it was about investor behavior.

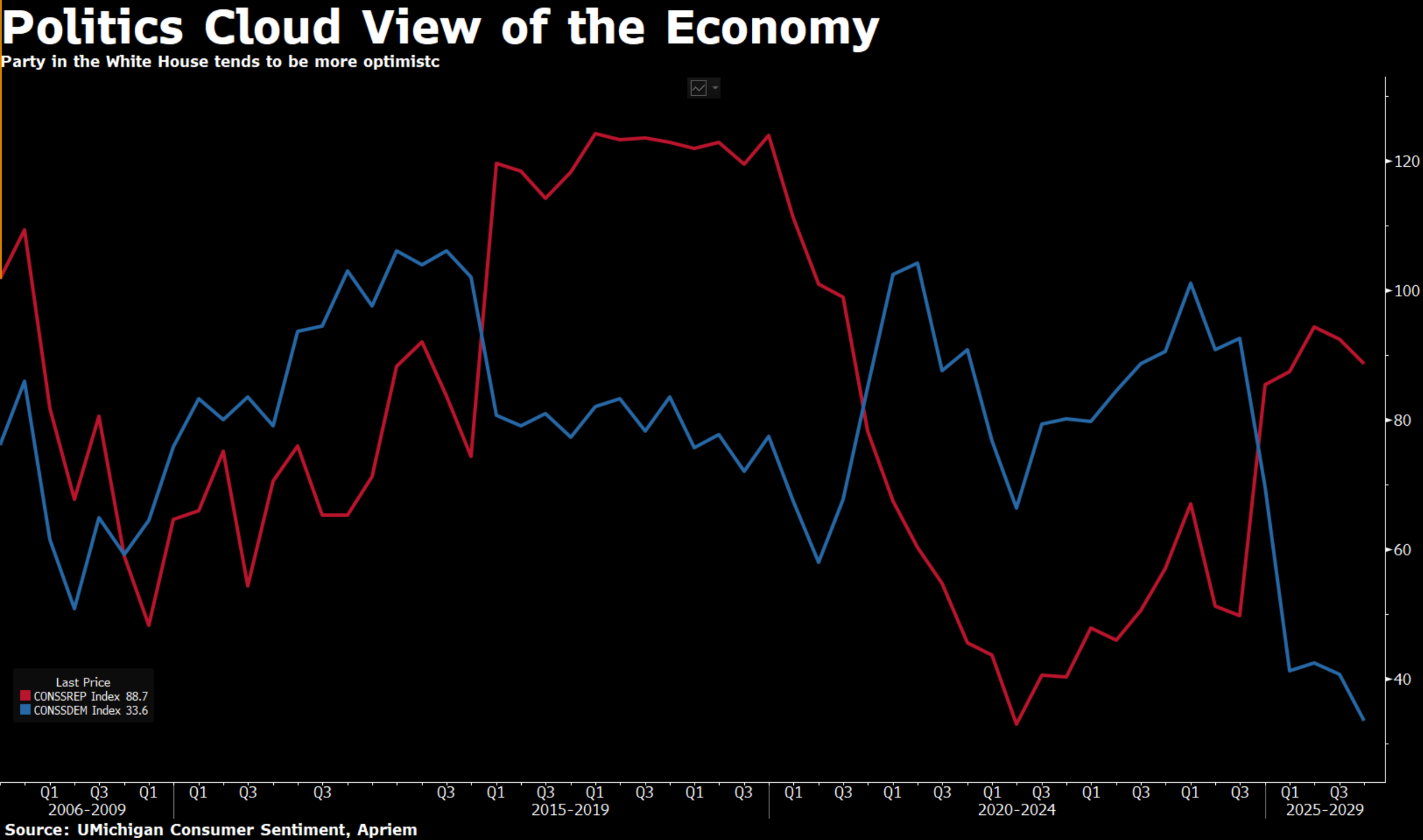

This issue was deeply polarizing, which made it tempting to act. But 2025 offered a clear reminder: trading based on political beliefs—on either side—rarely leads to good investment outcomes. Emotional reactions tend to come after prices have already moved. And politics is inherently emotional. Investors’ political beliefs have impacted their outlook on the economy; investors tend to be more upbeat if their party is in the White House (see below). Republicans (red line) tend to be more optimistic if a Republican is in the White House. Same with Democrats (blue line). And look at how quickly that sentiment can shift after an election, even if the economy hasn’t changed. We’veshown this chart before, but it’s a good one to repeat. Discipline mattered far more than emotions.

The U.S. Dollar, Gold, and Bitcoin

The U.S. dollar has had a wild ride in the past eighteen months. After Trump won reelection in late 2024, the U.S. dollar (for this I’m using the Dollar Index, which is comprised mainly of euros and yens) soared on his pro-America agenda. But the gains evaporated quickly as the new President laid out his tariff plans. What was more curious was that the sell-off in the U.S. dollar coincided with a sell-off in longer-dated bonds, pushing yields on long Treasuries higher (see next topic). The fact that both of these safe-haven assets fell in tandem was unusual from a historical standpoint.

Combine this sell-off with the rally in alternative assets like gold and bitcoin, and it reinforced conversations around the debasementtrade. These are no longer fringe discussions, but increasingly part of broader portfolio conversations. They aren’t replacements for traditional assets—but they aren’t easily dismissed either.

The Return of Bonds

Bonds had a pretty decent year in 2025. The past five years have been tough on bonds due to dramatic interest rate hikes spurred by rampant inflation. The hikes caused one of the worst bond markets in decades, and bonds have been flat since 2020. But now that the Federal Reserve has begun cutting short-term rates, bonds have stood to benefit. So far, bonds are up around 7% this year, and 2026 could be another decent year for bonds.

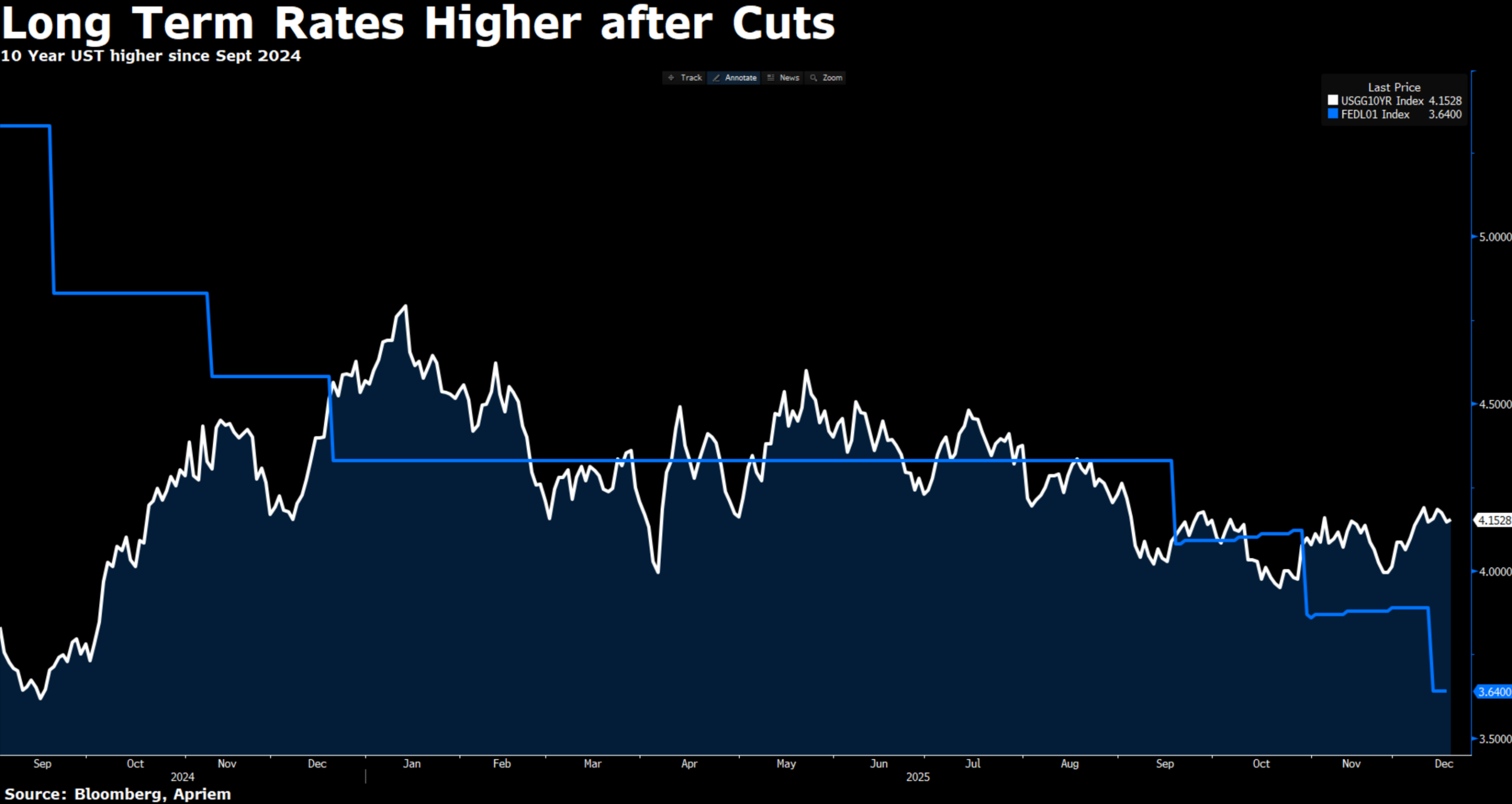

The bigger surprise in bonds this year was the behavior of interest rates. Since the Federal Reserve began cutting short-term rates in late 2024 (blue line), long-term 10-year Treasury yields moved higher (white line). This trend has been noticeable and could portend some issues in long-term government debt. Concerns around fiscal discipline and periodic government shutdowns didn’t help sentiment toward government bonds either. Questions around long-term debt sustainability also fueled interest in assets viewed as protection against currency debasement.

At the same time, we appear to be in the later stages of the credit cycle. While overall fixed income performed well, we remained cautious in certain areas of credit where risk compensation looked thin.

A Strong Economy – with Trade-Offs

From a big-picture perspective, the economy surprised to the upside. As mentioned above, Trump’s tariffs didn’t cause an economic implosion. Thanks to a decent economy, the job market remained relatively strong, supporting growth but also contributing to persistently higher inflation. But even with low unemployment, consumer sentiment stayed very low throughout the year. That is likely due to the unevenness of our economic growth. There are clearly many parts of the economy that aren’t doing as well as others.

Corporate profit growth was probably the brightest spot for us last year. Earnings-per-share (otherwise known as profit per share) growth accelerated again. Growth came in at 12% this year1—another impressive double-digit year. Of course, much of that came from artificial intelligence-related areas. While AI continues to be a meaningful long-term driver, we also became mindful of the risks. Since many technology (Mag 7) names are owned so widely and are heavily weighted in most index funds, many investors may be overly concentrated in tech or AI-related areas. On top of that, this AI trend is impacting many sectors besides technology, including communications, energy, and utilities. This “correlation of alphas” can be a hidden risk in many portfolios.

AI is real. The productivity gains are real. But not every company using the term deserves the same valuation.

While technology dominated much of the narrative, it wasn’t the only place returns showed up. Financials and healthcare both posted double-digit gains, reinforcing the importance of diversification as market leadershipbroadened. This was one of the healthier developments of 2025 and a positive signal for long-term investors.

2025 challenged investors to separate noise from signal, and emotion from opportunity. Those who stayed disciplined—and avoided reacting to every headline—were rewarded. As we head into 2026, our focus remains on balance, selectivity, and long-term fundamentals. And much like coaching kids through a long season, sometimes the most important role is reminding everyone to keep their eyes on the game—not the scoreboard.

Happy Holidays! – Ben Lau, CFA®, Chief Investment Officer

*As of 12/18/25

Disclosures:

Advisory services offered by Apriem Advisors (“Apriem”), a registered investment adviser with the United States Securities and Exchange Commission in accordance with the Investment Advisers Act of 1940. Any reference to or use of the terms “registered investment adviser” or “registered,” does not imply that Apriem Advisors or any person associated with Apriem Advisors has achieved a certain level of skill or training. Apriem Advisors may only transact business or render personalized investment advice in those states and international jurisdictions where we are registered, notice filed, or where we qualify for an exemption or exclusion from registration requirements. For complete information about our firm, please refer to our Form ADV Part 2A, 2B and CRS at any time.

The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. Past performance is no guarantee of future results. The reader should not assume that investments in the securities identified were or will be profitable.

Contact us today to see how we can assist you and your financial portrait.