A Lesson In Wealth For The Younger GenerationA Lesson In Wealth For The Younger Generation

The Man In The Car Paradox: A Lesson In Wealth For Younger Generations

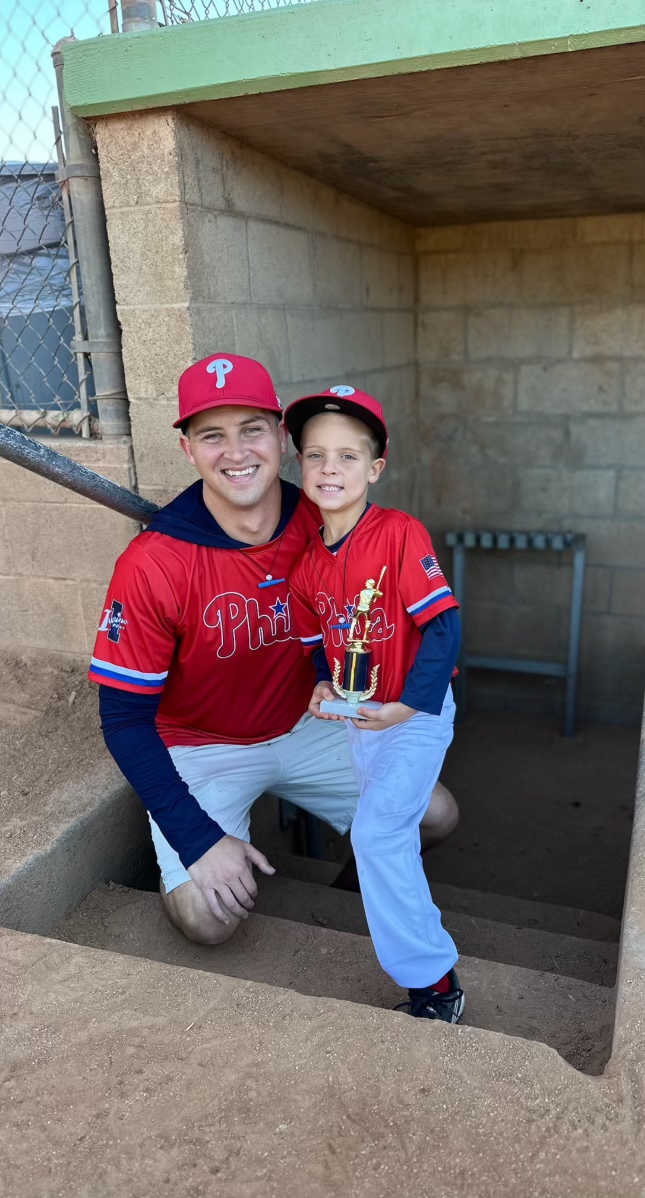

The other day, I was driving with my 6-year-old son, Colt, when we pulled up next to a bright red Ferrari at a stoplight. His eyes lit up.

“Whoa! That guy must be so rich! So cool!” he said.

I smiled and asked, “Do you think he’s cool—or do you think the car is cool?”

He paused for a moment, thinking it through.

“The car!” he said

Exactly. That’s the Man in the Car Paradox in action. We instinctively associate flashy things with success, but we’re usually admiring the object—not the person behind it.

I’m a little embarrassed to admit it took me years to internalize that truth. Now, I’m trying to help my kids grasp it early.

That thought—“If I had that car, people would think I’m cool”—needs to shift into something healthier:

“That’s a fun toy. Maybe I’ll buy one someday, but I know real wealth is what you don’t see. Real wealth is made up of the things money can’t buy.”

Like any meaningful lesson, this one will take repetition. I’m fully expecting eye rolls and shrugged shoulders as they grow—but I’ll keep reinforcing the idea that true financial wealth is freedom.

Freedom to say no.

Freedom from paycheck-to-paycheck stress.

Freedom from the pressure to impress.

It’s having money quietly working in the background—investments growing, options expanding, and your time truly being your own.

There are technical steps to reach that first level of financial independence—but the higher levels go far beyond money.

I deeply admire so many of our clients who’ve “won the game.” Yes, they might own beautiful things—homes, cars, vacations—but they’re not defined by them. They have nothing to prove.

They’ve moved on to deeper questions:

What is enough? What is my why? What are my family’s values?

Those are the questions I want my kids—and all of us—to be asking.

-Written by Christopher Whitaker, CFP®, AIF®, Chief Wealth Manager

Disclosures:

Advisory services offered by Apriem Advisors (“Apriem”), a registered investment adviser with the United States Securities and Exchange Commission in accordance with the Investment Advisers Act of 1940. Any reference to or use of the terms “registered investment adviser” or “registered,” does not imply that Apriem Advisors or any person associated with Apriem Advisors has achieved a certain level of skill or training. Apriem Advisors may only transact business or render personalized investment advice in those states and international jurisdictions where we are registered, notice filed, or where we qualify for an exemption or exclusion from registration requirements. For complete information about our firm, please refer to our Form ADV Part 2A, 2B and CRS at any time.

The information contained in this report is not written or intended as financial, tax or legal advice. The information provided herein may not be relied on for purposes of avoiding any federal tax penalties. You are encouraged to seek financial, tax and legal advice from your professional advisors. You should consult your tax and/or legal advisors before implementing any transactions and/or strategies concerning your finances.

Copyright © 2025 Apriem Advisors, All rights reserved.

Contact Chris today to see how he can assist you and your financial portrait.