In June of 2022, the U.S. hit a peak inflation rate of 9.1%. In an effort to stave off the increasing cost of goods, over the course of the year the FOMC increased the Fed Funds Rate from 0.00% to 4.50% resulting in what has been the fastest increase to the Fed Funds Rate in recent history. While this rapid increase in interest rates wreaked havoc on both the fixed income markets as well as the equity markets in 2022, it has created some new opportunities in 2023. Additionally, due to the increased attention in interest rates I am finding that we are having a lot of conversations about bonds and how they work.

What Are Bonds?

Investor.gov defines a bond as “a debt security, similar to an IOU.” Personally, I like to describe a bond as being a loan, when an investor purchases a bond, they are loaning money to the bond issuer for a specified period of time at a stated interest rate called a coupon. At the end of the term the bond issuer returns the investors money along with any accumulated interest along the way. Note that while this is meant to be an overly simplified description, bonds can be quite complex and there are a number of different types of bonds with each offering some of their own unique characteristics. Some of the more common varieties of bonds are:

- Plain Vanilla Bonds

- Zero-Coupon Bonds

- Callable Bonds

Who Issues Bonds?

As stated above, bonds are debt instruments that are issued as a representation of a loan meaning that they are a way to borrow money. Governments and corporations issue debt (bonds) to fund their many different projects. Local governments for example might be seeking funding to build new roads or update old infrastructure. Corporations often times are seeking capital for growth and expansion that does not require that they sell equity (stock) to generate funding. Along with the varying degree of bond issuers, there are multiple categories of bonds that have emerged. The four primary categories are:

- Government (Sovereign) Bonds, issued governments

- Agency Bonds, those issued by government-affiliated organizations such as Federal Home Loan Corporation, Freddie Mac, or Fannie Mae

- Municipal Bonds, issued by states and municipalities

- Corporate Bonds, issued by companies

Are Bonds Safe?

In comparison to many other asset classes such as equity markets or alternatives, bonds are generally considered to be a more conservative investment. However, like any investment, bonds bear their own varying levels of risk primarily credit risk, interest rate risk, and market risk. Focusing on credit risk, for example, a U.S. Treasury Bond is guaranteed by the full faith and credit of the United States Government, whereas a corporate bond is subject to the ability of the corporation/business itself to pay its liabilities. In comparing the two we can feel more confident in the ability of the U.S. to pay their debts than that a of a business, big or small. This difference in credit risk level is reflected in credit ratings defined by the three major credit rating agencies:

- Standard & Poor’s

- Moody’s Investors Services

- Fitch Ratings Inc.

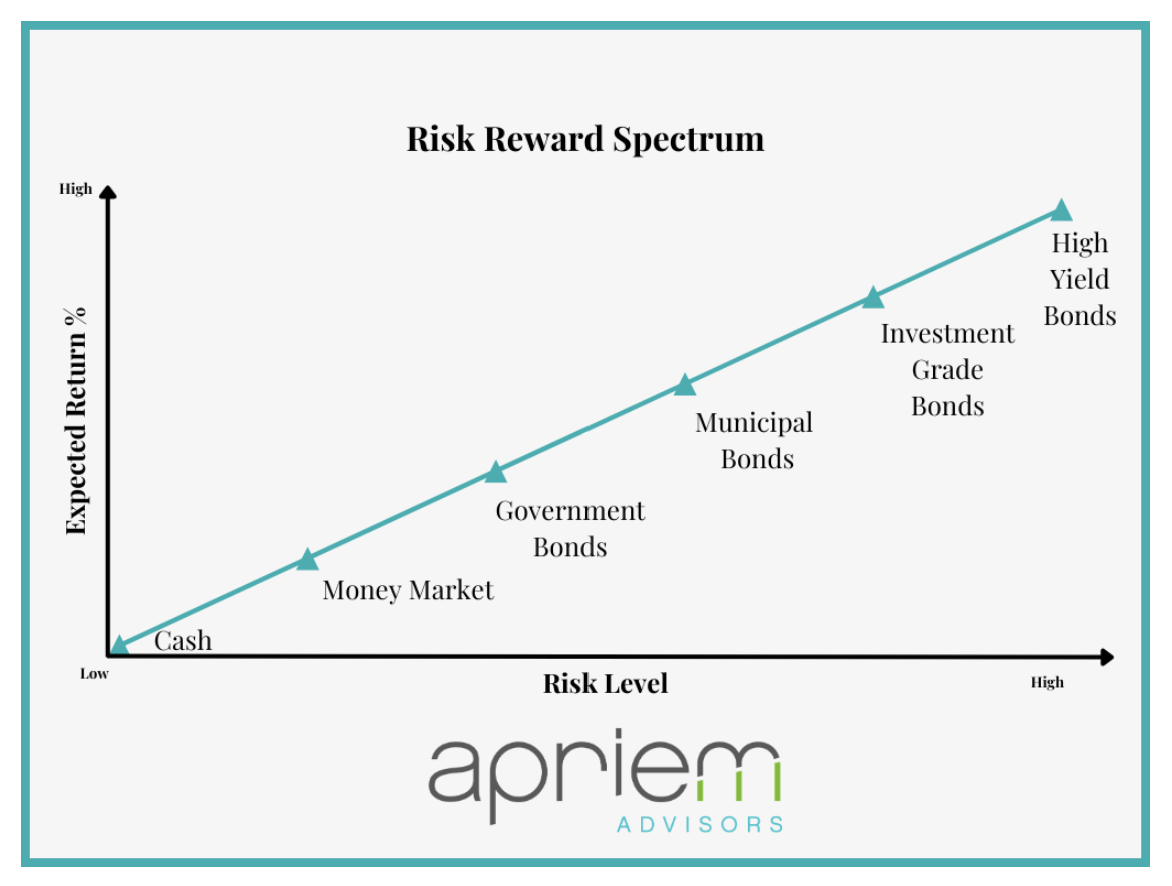

For example, Standard & Poor’s would assign investment grade bonds a “AAA” to “BBB-“rating, where lower credit quality bonds may fall all the way down to a “C”. Typically, the higher the rating the lower the rate of return and the lower the rating the higher the rate of return. This is due to the risk reward spectrum which tells us that in taking on more risk, an investor is going to require a higher potential rate of return to make that risk worth taking.

The Interest-ing Opportunity

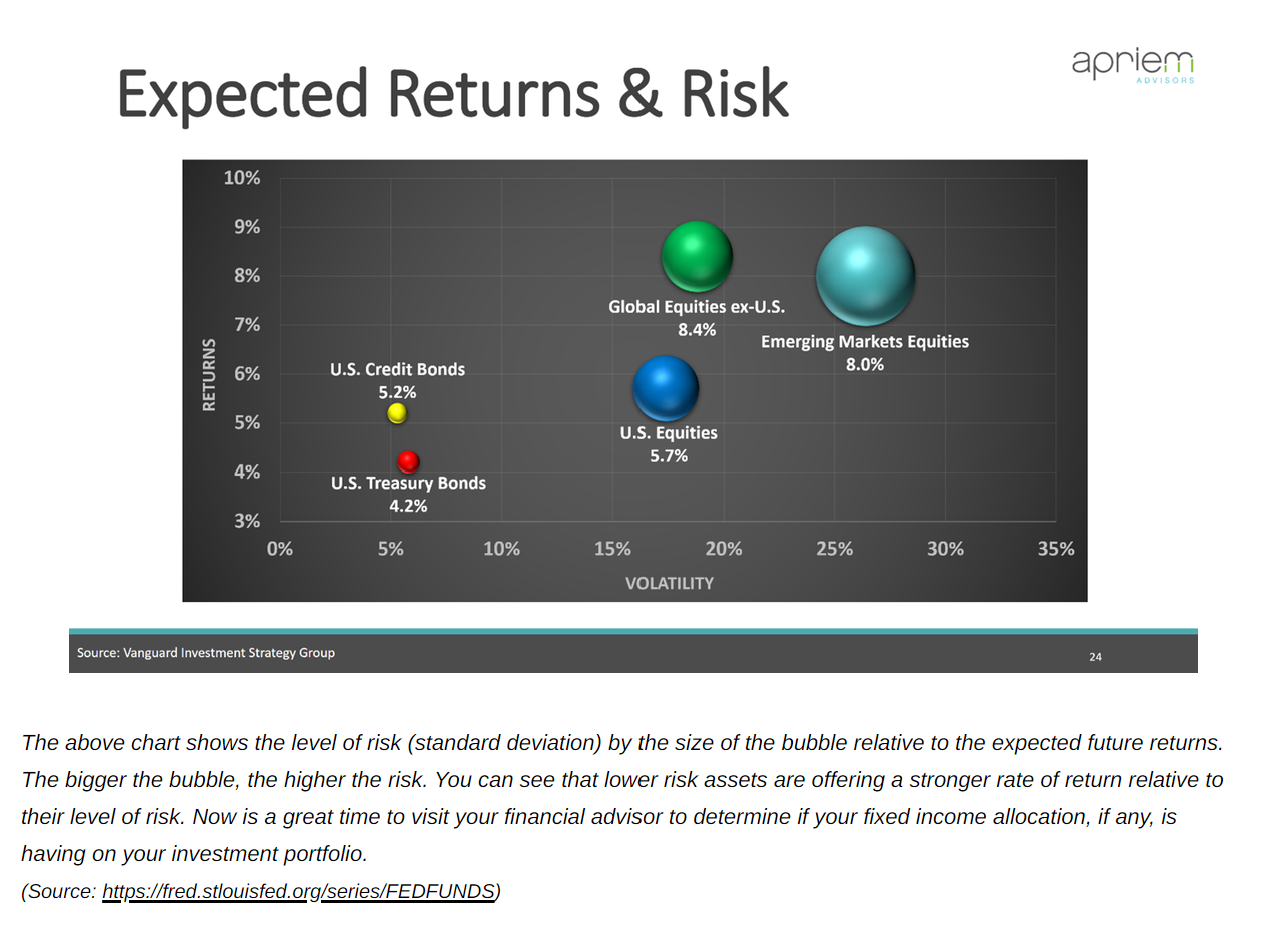

This brings us to the interesting opportunity that has developed over the last year. As the FOMC has continued to push its agenda of higher rates for longer in order to cool off inflation, we are seeing the newly issued bonds offer interest rates that are the highest they have been in over a decade! For example, just one year ago a 1-year U.S. Treasury Bond would yield slightly over 1%, fast forward to today (02/23/2023), a similar 1-year U.S. Treasury bond is offering a yield of approximately 5%. Compare this to the expected returns for equity markets which require substantially more risk, and you can spot the difference.

Joshua J. Garland, ChFC®, AIF®

Financial Advisor

Disclosures:Advisory services offered by Apriem Advisors (“Apriem”), a registered investment adviser with the United States Securities and Exchange Commission in accordance with the Investment Advisers Act of 1940. Any reference to or use of the terms “registered investment adviser” or “registered,” does not imply that Apriem Advisors or any person associated with Apriem Advisors has achieved a certain level of skill or training. Apriem Advisors may only transact business or render personalized investment advice in those states and international jurisdictions where we are registered, notice filed, or where we qualify for an exemption or exclusion from registration requirements. For complete information about our firm, please refer to our Form ADV Part 2A, 2B and CRS at any time.The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. Past performance is no guarantee of future results. The reader should not assume that investments in the securities identified were or will be profitable.”“The S&P 500 Index is a free-float market capitalization weighted index of 500 of the largest U.S. companies. The Dow Jones Industrial Average, or DJIA, is a price-weighted index that measures the performance of 30 large publicly-owned companies in the U.S. The NASDAQ Composite Index covers more than 2,500 stocks in The Nasdaq Stock Market. All index data is reported on a total return basis, which includes dividends.One cannot invest directly in an index, and index returns do not reflect the deduction of advisory fees, brokerage or other commissions, and any other expenses a client would have paid, and that these expenses would negatively impact performance.” |