“We live in a ‘reap what you sow’ world. It is really no more complicated than that.”

– Peter “Grandpete” Taylor

Brace yourself for the millennial view!

There ar e so many negative stereotypes associated with my generation that it’s hard to keep up with them all. To name a few, we’ve been called “too coddled with participation trophies,” “devoid of in-person communication skills,” “eager to spend money without regard of the future,” “overly ambitious” and “disloyal to our employers.” Now, a lot of these labels are unfair, but they aren’t completely off base. Stereotypes do stem from somewhere, and participation trophies do exist.

However, I choose to view these stereotypes as an opportunity. Like my millennial co-workers at Apriem, I understand the importance of integrity and if others my age do not, then I can stand out.

This idea comes from another millennial stereotype, which is one that I fully embrace: millennials view their grandparents as heroes. I was very fortunate to be born into a loving middle-class family that poured into me in many positive ways. My grandfather (we affectionately call him “Grandpete” in my family) is a very wise person who I look to continuously for advice. There is one lesson from my Grandpete that truly altered the course of my life.

This idea comes from another millennial stereotype, which is one that I fully embrace: millennials view their grandparents as heroes. I was very fortunate to be born into a loving middle-class family that poured into me in many positive ways. My grandfather (we affectionately call him “Grandpete” in my family) is a very wise person who I look to continuously for advice. There is one lesson from my Grandpete that truly altered the course of my life.

We were sitting around his kitchen table, talking about life and the nuances of responsibility. He proceeded to go into more detail on the concept of “you reap what you sow” and how it seeps into all areas of life. It was one of those ‘light bulb’ moments for me. Grandpete helped me think about how far ahead I could get if I were to deploy this simple but profound concept. From a young age, I believed I could use Grandpete’s wisdom. I have since applied this lesson in key areas such as managing money, working hard and developing lasting relationships.

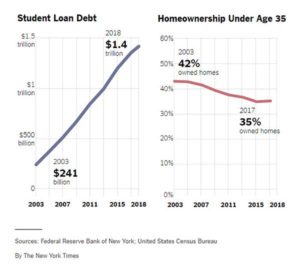

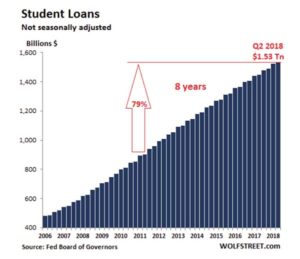

Unfortunately, not many millennials have a Grandpete in their life. One of the ways we are seeing this show up financially is in the form of student loan debt. A lot of millennials were not educated on what kind of seeds they were sowing when they signed up for what amounts to an enormous heap of student loans. This becomes a huge drag on their finances right as they are entering the work force. This further compounds into an inability to own their first homes or max out retirement accounts until much later in life.

While millennials and their Generation Z successors still need a college degree to be competitive in most lines of work, we are starting to see is a shift in how they navigate around this dilemma. The main solution is a very, well, millennial one: utilizing the many online resources that are widely available. Online universities are significantly cheaper because of the lower overhead on the college’s side, and they’re incredibly convenient because you can complete courses on your own time. There is even a unique offering through schools such as Western Governors University or Capella University that allow a student to pay a few thousand dollars for access to as many units that they can finish in a set time frame. So yes, highly motivated individuals with some time on their hands could finish a bachelor’s degree in a matter of months for only a few thousand dollars.

While millennials and their Generation Z successors still need a college degree to be competitive in most lines of work, we are starting to see is a shift in how they navigate around this dilemma. The main solution is a very, well, millennial one: utilizing the many online resources that are widely available. Online universities are significantly cheaper because of the lower overhead on the college’s side, and they’re incredibly convenient because you can complete courses on your own time. There is even a unique offering through schools such as Western Governors University or Capella University that allow a student to pay a few thousand dollars for access to as many units that they can finish in a set time frame. So yes, highly motivated individuals with some time on their hands could finish a bachelor’s degree in a matter of months for only a few thousand dollars.

I think that most millennials view the “American Dream” as being able to do something that they truly love to do, but still make enough money to accomplish their key goals in life. If you can own a home and max out your retirement accounts early on, financial independence can happen relatively early in life! That type of vision is tough to pull off when you don’t plant the right seeds from the beginning.

I think that most millennials view the “American Dream” as being able to do something that they truly love to do, but still make enough money to accomplish their key goals in life. If you can own a home and max out your retirement accounts early on, financial independence can happen relatively early in life! That type of vision is tough to pull off when you don’t plant the right seeds from the beginning.

I am passionate about helping my fellow young adults set out on the right financial paths, and I look forward to diving deeper into this topic.