By Jennifer Olson, CFA, CIPM, AIF®, CFP®, VP-Finance

Nine years ago, I dated a guy whose food budget was $25 a week. What?!? How can someone live on that budget? People wondered why I would date a struggling 25-year-old part-time college student who was working full-time to send himself to college. But I was fascinated and intrigued by him (plus, I thought he was handsome), so I dated him for over a year anyway. Let’s call him “Paul.”

Apriem is a multi-generational firm, serving a spectrum of clients from different ages, life stages, wealth, and circumstances. Our clients have now started to engage their children to teach them about finances. If you know a Millennial who is just starting their financial journey or anyone who is struggling in their financial circumstance, here’s a story for you.

How can you manage your finances when your income is tight? How can you strength-train your financial muscles by creating good habits? Let me tell you the six financial lessons I learned from dating Paul:

1. Your budget is your best friend. Create a budget and keep it simple. (For more information, read my article on Budgeting.)

1. Your budget is your best friend. Create a budget and keep it simple. (For more information, read my article on Budgeting.)

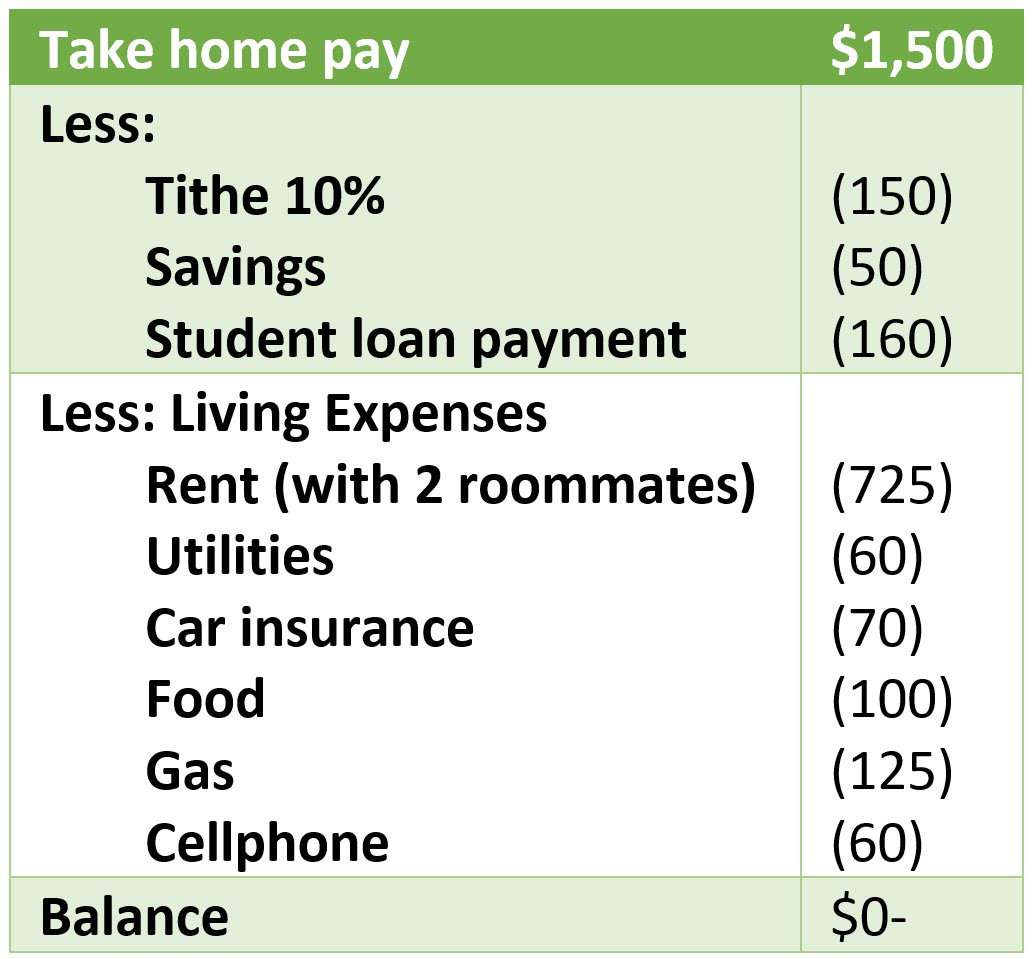

Paul took home $1,500 a month. This table shows what his monthly budget looked like.

2. Start small and slowly work your way up. List the steps that you need to take, such as reducing expenses, paying off debt, starting a savings plan, or finding an additional job. Find a method that works for you. Whatever you do, don’t try to do everything at once. It may be worth your time to attend financial literacy seminars for ideas on how to start your financial journey.

Paul attended Dave Ramsey’s Financial Peace University to get a head start in managing his finances. One of the methods that he used was the “envelope method.” In this method, he had two envelopes for his flexible spending: one labeled “gas” and one labeled “food.” Each month, he put cash corresponding to his monthly budget into each envelope. Once the gas envelope or food envelope was empty, he had to limit his driving or food purchases until the following month, when the envelope was replenished.

3. Spend according to your needs. Make a list of your current spending and distinguish needs from wants. Prioritize those things that you genuinely need, and cross off those things that you don’t. Make necessary adjustments. Given what you have, find ways to make the most of it. If there is a will, there’s a way.

With a $25 food budget, Paul learned to cook and pack his own lunch. Instead of eating a top ramen diet, he did the best with what he had. He cooked mostly pasta, just changing up the meat and sauces (using whatever was on sale). Almost every day for two years, he ate pasta for lunch and dinner.

I don’t recommend you eating pasta every day, but the point is to make adjustments in order to live within your means.

4. Prioritize your savings goals. Despite how much you make, always make it a point to save. First, create an emergency fund that is equivalent to three to six months of your living expenses. Then, contribute toward your retirement account. Lastly, create a savings plan for other goals, such as buying a home, travel, etc.

Paul used the “bucket method” when it came to savings. Every pay day, he would sit down to move his earnings into particular “buckets,” such as tithe and savings. He didn’t use auto-pay for bills and student loans or direct deposit for his savings. He wanted to get in the habit of intentionally moving his money to where it should be.

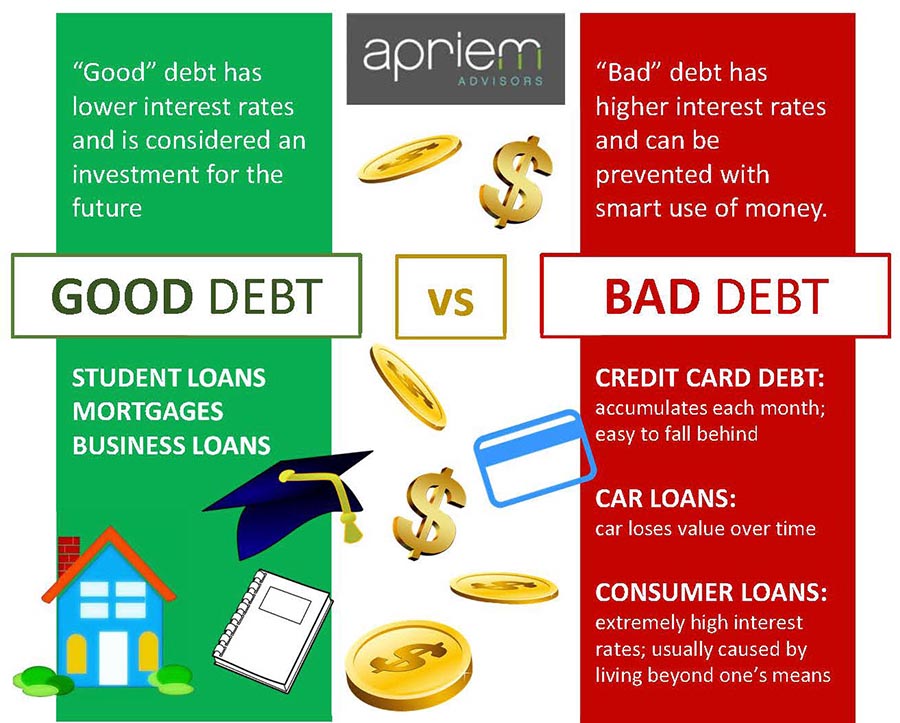

5. Use debt purposefully.Some debts are okay if they are for something that is essential (home mortgage, business expenses, etc.) or an investment that will grow in value (student loan). If you’re financially struggling and want to create good habits, stop using your credit card. What attracts most of us to credit cards are those “rewards” from using them, such as points and mileage.

Paul’s only debt was his student loans, which were necessary for his circumstances. He refused to incur credit card debt. Given his limited food budget, our date nights consisted of cooking food at home.

Once you have mastered healthy financial habits, you’ll be in a better position to use those credit cards, get those rewards, and pay off your balance every month.

6. Find support from trusted peers. Identify people you can trust (family, loved ones, friends) and be transparent about your financial situation with them. It could be one of the most important steps toward improving it. Find people who can support you and motivate you, not pressure you to do things that will jeopardize your financial standing. Consider having a potluck get-together instead of going out to dinner, carpooling with neighbors, or having roommates!

Paul was transparent with his roommates, and they were there to motivate him toward his goals. They did not pressure him to go out, and they held him accountable for his actions.

Fast-forward nine years: Paul was able to graduate with honors from the university. Within 2½ years, he moved up from an intern to an analyst, then to a senior analyst in the private banking sector. His student loans are now paid off. He continues to move up his career in investment finance and bought his first home. His circumstances are better, but his good habits have not changed. He’s proof of the saying, “Whoever is faithful in very little is also faithful in much.” Paul was able to get through the tough times by following these six financial habits. If you practice the same habits and strengthen your financial muscles, then you’ll be able to handle the outpouring of any future wealth. Focus on your long-term goals, and do not give up because it does get better.

Seven years ago, I dated a guy whose food budget was $25 a week. People wondered why. But I saw something more to him than meets the eye. We have been married for over 7 years now, and his name is Matthew Paul.