By Landon Yoshida, CRPC®, Vice President Wealth Management

What would your retirement savings look like if you lived into your 90s and beyond? How about at 104 years old? This type of longevity is more common now in America. At Apriem Advisors, we believe that preparation through proper long-term financial planning is essential.

In fact, I had to look no further than the grandmothers in my own family. These four have lived a long time by today’s standards.

- Great-Grandma Yoshida, 104

- Great-Grandma Kodama, 99

- Grandma Joyce, 92 and still going strong (and still loving her Sanka and Coke!)

- Grandma Dorothy, 88

Each one was very fortunate to receive guaranteed pensions. Their financial situations were simple, and they lived within their means to fulfill their longevity. The common denominator was an income guarantee in their retirement years. Whether it was social security, a pension from the U.S. Postal Service, or a U.S. Army survivor’s pension, all were reliable sources of income for them.

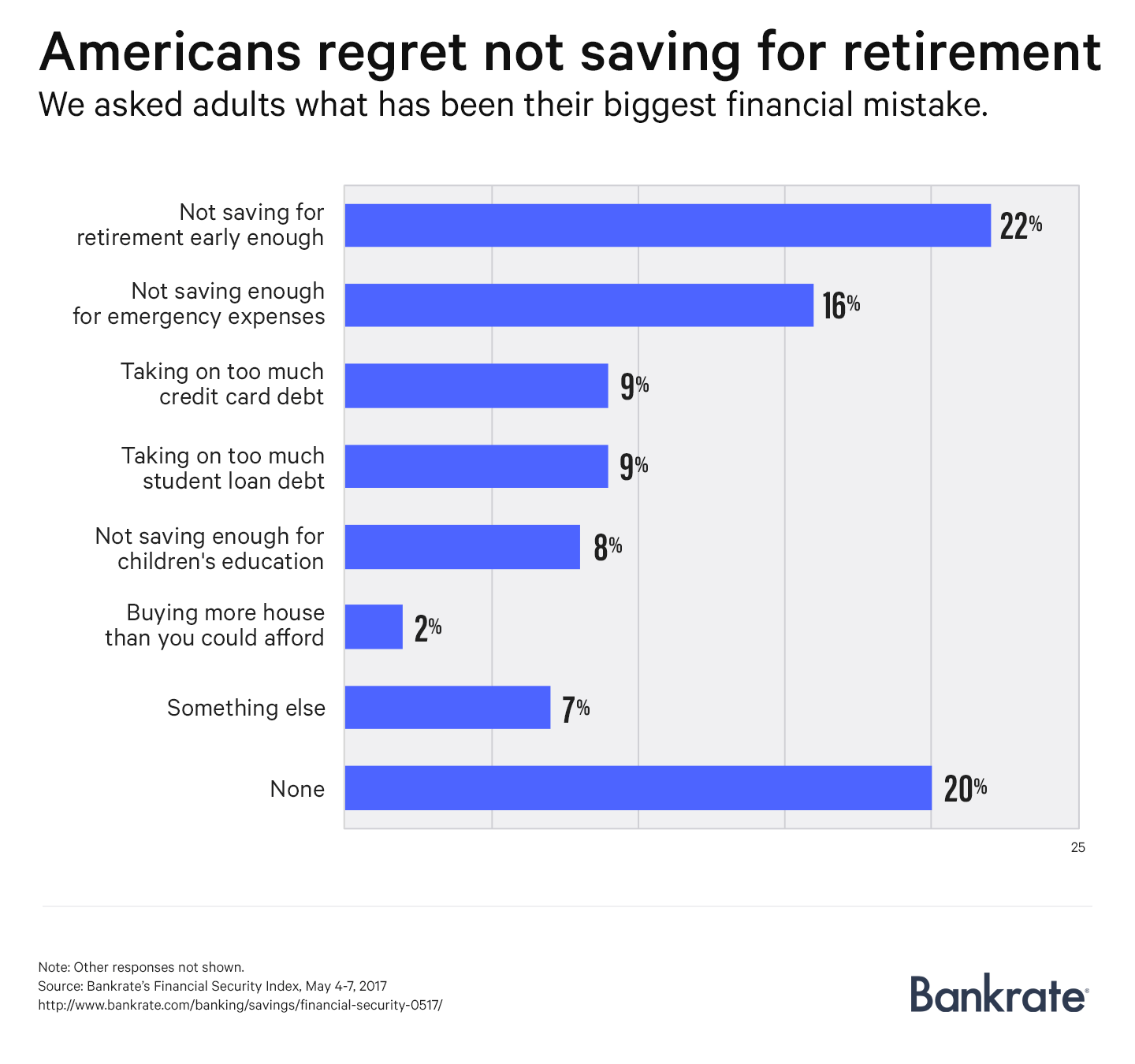

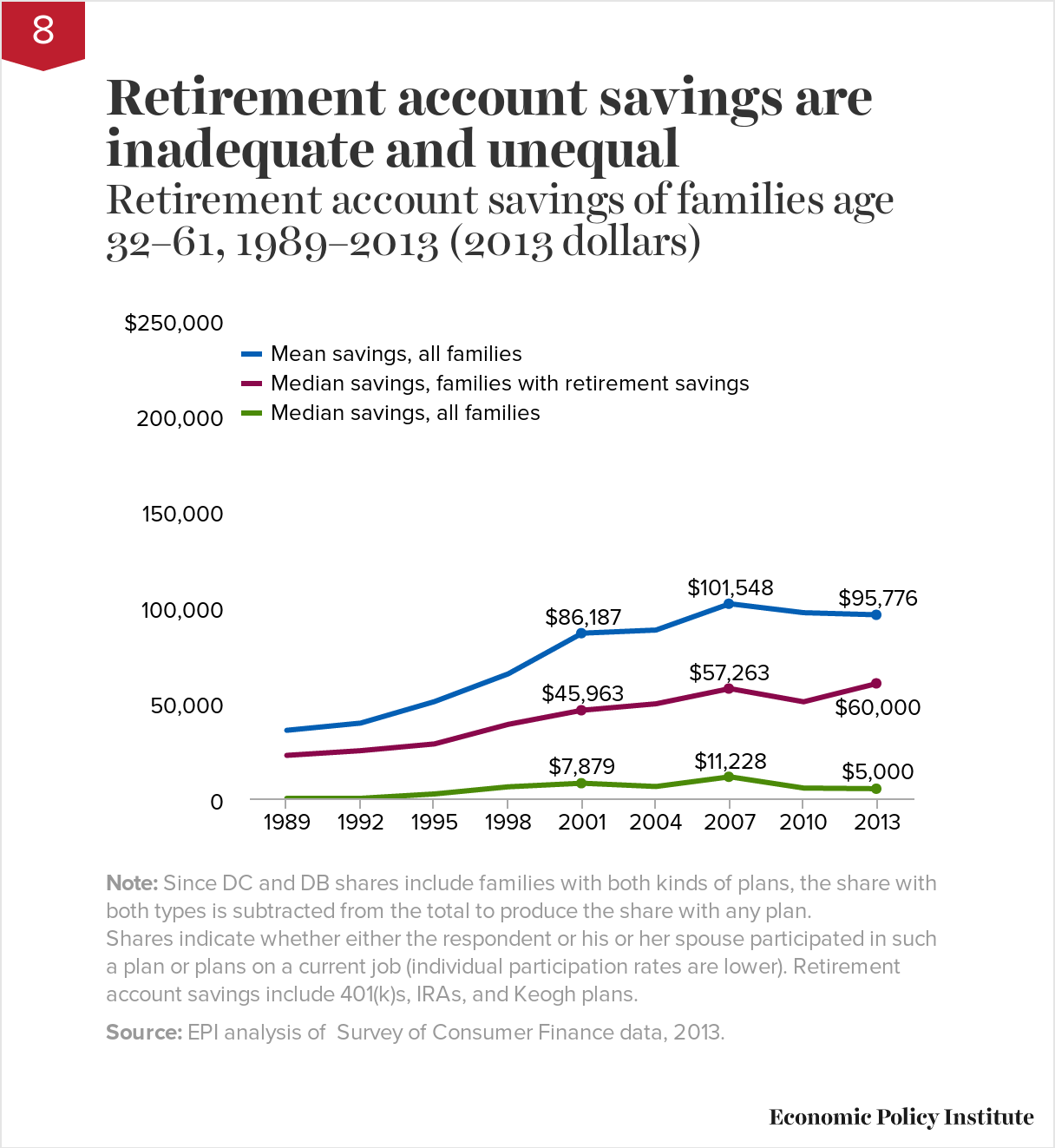

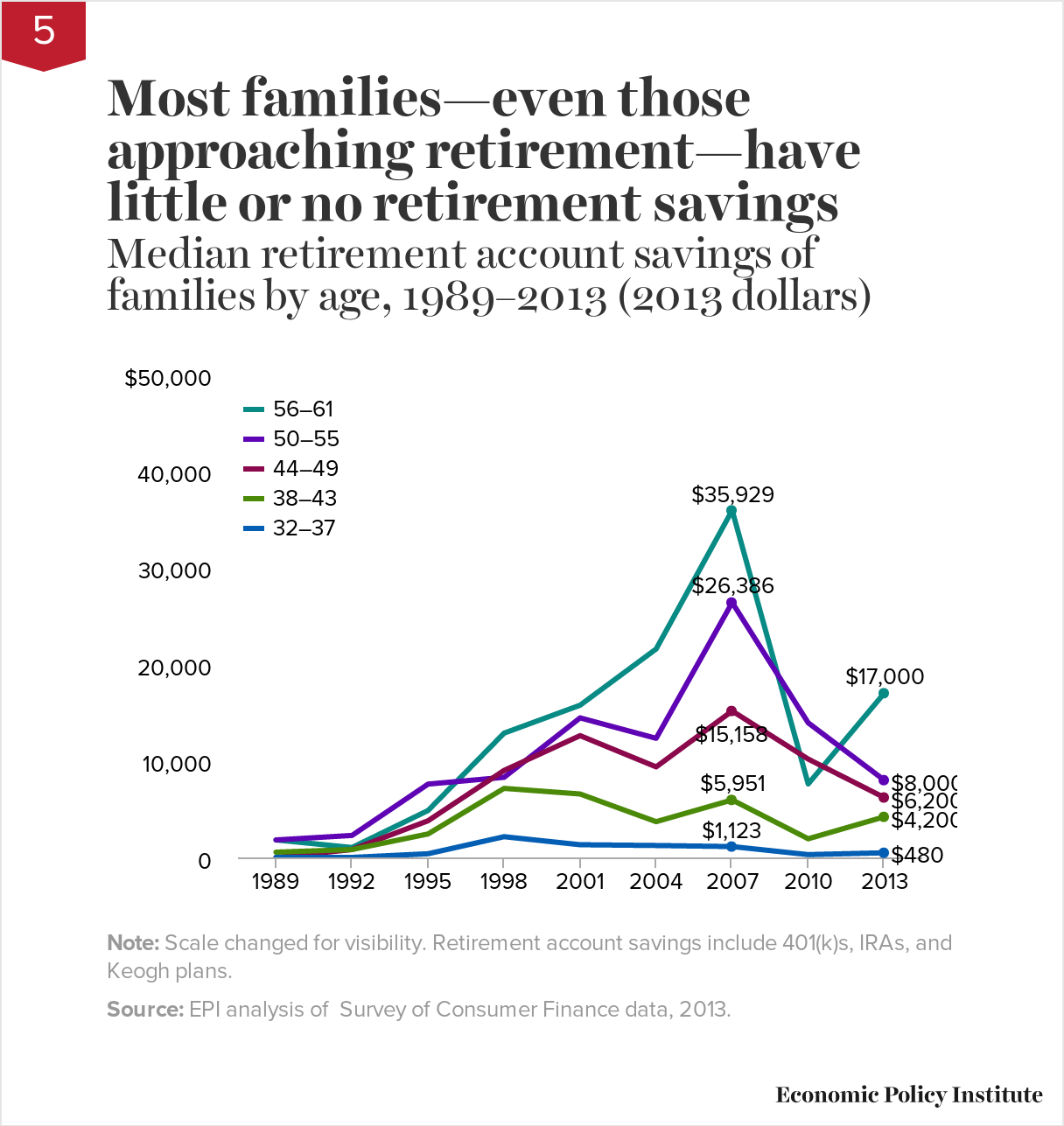

Based on retirement research, if a woman reaches the age of 65 today, on average, she can expect to live to the age of 85.6. For men, the life expectancy is 83! So why are the majority of Americans unprepared for retirement? According to the Economic Policy Institute, “nearly half of families have no retirement account savings at all.”

As our population ages with longer life spans, pension funds are strained. These funds have been unable to keep up with the promised payouts to retirees and as a result, most American workers rely on their own savings to supplement their retirement.

With this new retirement perspective, I thought about the longevity of how retirement income used to be portrayed. They were referred to as the “three-legged stool” of retirement. The three ‘legs’ that ensured a sound retirement are as follows:

- Pension income

- Social Security income

- Personal savings

Without pensions, Americans must prepare themselves with the likelihood that one of the three legs will not be available in retirement. That makes it critical to connect with a great advisor who is focused on a long-term financial plan that will evolve over time.